Pradhan Mantri Jeevan Jyoti Bima Yojana: Empowering Lives through Financial Security

Introduction:

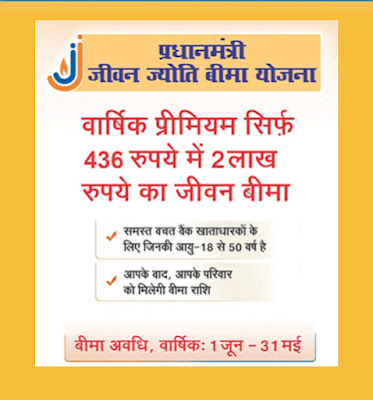

In a country like India, where a significant portion of the population lacks access to financial security, the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) has emerged as a crucial initiative. Launched on May 9, 2015, by the Government of India, this life insurance scheme aims to provide affordable life insurance coverage to individuals from all walks of life. In this blog post, we will explore the key features, benefits, and impact of the Pradhan Mantri Jeevan Jyoti Bima Yojana.

Key Features:

1. Affordable Premiums: One of the primary goals of PMJJBY is to make life insurance accessible to every citizen. The scheme offers a low premium of only Rs. 436 per annum, making it affordable for even those from economically weaker sections of society.

2. Age Eligibility: Any individual aged between 18 and 50 years can enroll in PMJJBY. Once enrolled, the policy remains valid until the age of 55, ensuring a considerable coverage period.

3. Life Coverage: PMJJBY provides life insurance coverage of Rs. 2 lakh (INR) in case of the policyholder's death, regardless of the cause. This amount acts as a crucial financial support system for the family, helping them cope with the loss and ensuring their financial stability.

4. Easy Enrollment: The enrollment process for PMJJBY is hassle-free. Individuals can simply approach their respective banks and fill out a simple application form to register for the scheme. The premium amount is automatically deducted from the policyholder's bank account on an annual basis.

5. Renewable Scheme: PMJJBY operates on an annual renewable basis, which allows individuals to continue their coverage by paying the premium amount every year. This ensures a long-term financial safety net for the policyholders and their families.

Benefits and Impact:

1. Financial Security: PMJJBY addresses a significant gap in the Indian insurance sector by providing life insurance coverage to a large number of individuals who were previously uninsured. This scheme has brought financial security to millions of households, especially those from low-income backgrounds.

2. Inclusive Approach: PMJJBY follows an inclusive approach, making it accessible to people from various socio-economic backgrounds. The low premium amount and easy enrollment process have enabled individuals from all walks of life to avail themselves of life insurance coverage.

3. Empowering Families: The sudden demise of a family's primary breadwinner can have devastating consequences. PMJJBY plays a vital role in empowering the families of policyholders by providing them with a substantial sum assured in the event of the policyholder's death. This financial support enables them to meet immediate expenses, pay off debts, and secure their future.

4. Widening Insurance Penetration: The implementation of PMJJBY has contributed significantly to increasing insurance penetration in India. By encouraging individuals to prioritize life insurance, the scheme has played a crucial role in spreading awareness about the importance of financial planning and risk mitigation.

Important Link

Visit Official Website : https://jansuraksha.gov.in/

પ્રધાનમંત્રી જીવન જ્યોતિ વીમા યોજનાની ગુજરાતીમાં માહિતી મેળવવા : અહીં ક્લિક કરો.

Conclusion:

The Pradhan Mantri Jeevan Jyoti Bima Yojana has emerged as a transformative initiative in India's insurance landscape. By providing affordable life insurance coverage to a vast number of individuals, the scheme has helped bridge the financial security gap and empower households across the country. PMJJBY's inclusive approach, easy enrollment process, and substantial coverage have made it a game-changer in the realm of life insurance. With its continued implementation and support, PMJJBY has the potential to uplift millions of lives by providing them with the much-needed financial security and peace of mind.